(!)Due to Microsoft's end of support for Internet Explorer 11 on 15/06/2022, this site does not support the recommended environment.

Instead, please kindly use other browsers like Google Chrome, Microsoft Edge or Mozilla Firefox.

50,000 Stock items for Same Day Ship Out.

All Categories

Categories

- Automation Components

A wide variety of standard and configurable components for factory automation engineers in industries such as automotive, semiconductor, packaging, medical and many more.

- Linear Motion

- Rotary Motion

- Connecting Parts

- Rotary Power Transmission

- Motors

- Conveyors & Material Handling

- Locating, Positioning, Jigs & Fixtures

- Inspection

- Sensors, Switches

- Pneumatics, Hydraulics

- Vacuum Components

- Hydraulic Equipment

- Discharging / Painting Devices

- Pipe, Tubes, Hoses & Fittings

- Modules, Units

- Heaters, Temperature Control

- Framing & Support

- Casters, Leveling Mounts, Posts

- Doors, Cabinet Hardware

- Springs, Shock Absorbers

- Adjusting, Fastening, Magnets

- Antivibration, Soundproofing Materials, Safety Products

- Fasteners

A good selection of accessories such as screws, bolts, washers and nuts that you may need for your daily engineering usage.

- Materials

Browse industrial materials ranging from heat insulating plates, sponges, to metal and plastic materials in different sizes to meet your various applications.

- Wiring Components

A wide variety of wiring parts for connecting and protecting control and PC parts including Connectors, Cables, Electric Wires, Crimping Terminals and more.

- LAN Cables / Industrial Network Cables

- Cables by Application

- Cables with Connectors

- RS232 / Personal Computers / AV Cables

- Wires/Cables

- Connectors (General Purpose)

- Crimp Terminals

- Zip Ties

- Cable Glands

- Cable Bushings/Clips/Stickers

- Screws/Spacers

- Cable Accessories

- Tubes

- Protection Tubes

- Ducts/Wiremolds

- General Purpose Tools

- Dedicated Tools

- Soldering Supplies

- Electrical & Controls

A wide variety of controls and PC parts for electrical engineers including Controls, Powers, PC parts and more.

- Cutting Tools

A wide variety of cutting tools for many uses and work materials including End Mills, Drills, Cutters, Reamers, Turning Tools and more.

- Carbide End Mills

- HSS End Mills

- Milling Cutter Inserts/Holders

- Customized Straight Blade End Mills

- Dedicated Cutters

- Turning Tools

- Drill Bits

- Screw-Hole-Related Tools

- Reamers

- Chamfering / Centering Tools

- Fixtures Related to Cutting Tools

- Step Drills

- Hole Saws

- Clean Key Cutters

- Core Drills (Tip Tools)

- Magnetic Drilling Machine Cutters

- Drill Bits for Electric Drilling Machines

- Woodworking Drill Cutters

- Drills for Concrete

- Processing Tools

A wide variety of tools and supplies used in processing including Machine Tools, Measurement Tools, Grinding and Polishing Supplies and more.

- Material Handling & Storage

A wide variety of goods used in shipment, material handling and warehouse including Tape supplies, Stretch film, Truck, Shelf, Crane and more.

- Tape Supplies

- Cushioning Materials

- Stretch Films

- Cardboard

- Plastic Bags

- PP Bands

- Magic Tapes / Tying Belts

- Rubber Bands

- Strings/Ropes

- Cable Ties

- Tags

- Labelers

- Unpacking Cutters

- Packing Support Equipment

- Cloth Sheets for Packing

- Conveyance/Dolly Carts

- Tool Wagons

- Tool Cabinets / Container Racks

- Lifters / Hand Pallets

- Container Pallets

- Storage Supplies

- Shelves/Racks

- Work Benches

- Suspended Clamps/Suspended Belts

- Jack Winches

- Chain Block Cranes

- Bottles/Containers

- Bicycle Storage Area

- Safety & General Supplies

A large variety of goods for every kind of factories and offices including Protection items, Cleaning supplies, sanitations, office supplies and more.

- Lab & Clean Room Supplies

A large variety of items used in R&D and Clean Room including research Equipment, Laboratory Essentials, Analysis Supplies, Clean Environment-Related Equipment and more.

- Press Die Components

Choose from thousands of standard stamping die components including Punch & Die, Gas Springs, Guide Components, Coil Springs and many more.

- Plastic Mold Components

Browse our wide variety of mold components including Ejector Pins, Sleeves, Leader Components, Sprue Bushings and many more.

- Ejector Pins

- Sleeves, Center Pins

- Core Pins

- Sprue bushings, Gates, and other components

- Date Mark Inserts, Recycle Mark Inserts, Pins with Gas Vent

- Undercut, Plates

- Leader Components, Components for Ejector Space

- Mold Opening Controllers

- Cooling or Heating Components

- Accessories, Others

- Components of Large Mold, Die Casting

- Injection Molding Components

Browse our injection molding components including Heating Items, Couplers, Hoses and more.

- Injection Molding Machine Products

- Accessories of Equipment

- Auxiliary Equipment

- Air Nippers

- Air Cylinders

- Air Chuck for Runner

- Chuck Board Components

- Frames

- Suction Components

- Parallel Air Chuck

- Special Air Chuck

- Chemical for Injection Molding

- Mold Maintenance

- Heating Items

- Heat Insulation Sheets

- Couplers, Plugs, One-touch Joints

- Tubes, Hoses, Peripheral Components

Search by Application

Brands

Boost Mechanisms and Lever Mechanisms (Boost Mechanism Basics)

This article is Part 5 in the Fundamentals Series. Could you move the earth using leverage? An introduction of boost mechanisms with examples of how levers, toggles and crank mechanisms are used

- Boost mechanisms and lever mechanisms

- Toggle mechanisms

- Usage example of boost mechanisms

This month's special feature provides a simple introduction to boost mechanisms. It covers the mechanical elements used in boost mechanisms and provides some examples of how they are used.

Be sure to read all the way through to the end of the article, as you'll find a fascinating calculation showing how long a lever you'd need to move the earth!

What is a boost mechanism?

A boost mechanism is a contrivance that generates a large force from a small force by using the principle of balancing moments (a force multiplied by a distance).

Boost mechanisms are used for machine elements such as links, levers, screws, wedges, gears and pulleys.

Boost mechanism 1: Levers

A lever is a device consisting of long rigid body supported on a point known as the fulcrum. Levers are used to move large objects with small forces, or to change small motions into large motions.

Lever

Lever components

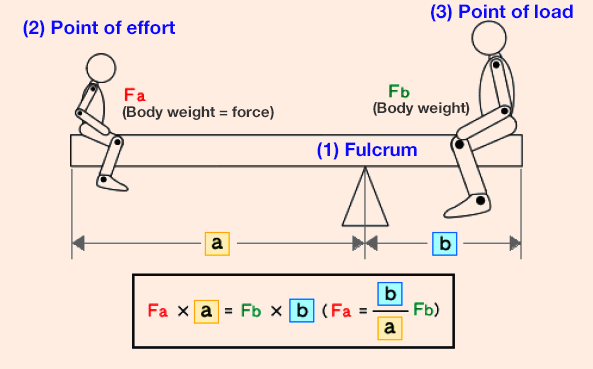

A lever has three components: The fulcrum, the point of effort, and the point of load.

- 1.The fulcrum: The point at which the lever is supported

- 2.The point of effort: The point at which an external force is applied to one side of the lever

- 3.The point of load: The point at which the force on the other side of the lever acts

Lever mechanism

To understand how a lever works, the key point to understand is:

The moment at the point of effort (the force applied to the point of effort multiplied by the distance between the fulcrum and point of effort) is equal to the moment at the point of load (the force generated at the point of load multiplied by the distance between the fulcrum and point of load).

In other words, the moments at these two points are balanced.

So by shortening the distance between the point of load and the fulcrum, a greater force can be applied to the point of load than the force applied to the point of effort.

Leverage-based boosting tools are commonly used in everyday life. Examples include nail clippers, crowbars and faucet handles.

Figure 1 Seesaw type boost mechanism

[Mini Column] Leverage: A boosting technique used by investors

Boosting is a way to generate a large force from a small force. Boosting also has an analog in the investment world known as "leverage".

In the context of investing, leverage means borrowing money to increase the rate of return you receive on your own money.

Needless to say, you will need to pay interest on the borrowed money, but the interest will be a fixed amount unrelated to the profit. The greater your profits, the greater your earnings and the final return on your investment.

Let's look at an example.

Consider return on your investment for each of two cases when the annual investment is 100 yen and the annual return is 20 yen.

- 1.If you invest 100 yen of your own money, your return will be 20 yen divided by 100 yen = 20%.

- 2.If you invest 50 yen of your money and borrow an additional 50 yen at an annual interest rate of 10%, your overall return will be 20 yen divided by 50 yen = 40%. But of course we also need to subtract the 5 yen paid in interest, giving us 15 yen divided by 50 yen = 30%.

So if Person A and Person B each have 100 yen to invest, Person A will generate a profit of 20 yen if they only invest their own money, while Person B will generate a profit of 30 yen if they use the leverage described in this example. So Person B will earn 10 yen more than Person A.

This use of borrowed money to boost the rate of return you can receive from a given amount of your own money is called leverage.

Leverage can be used to increase the rate of return on an investment when the investment is expected to generate greater earnings than the interest and other costs of borrowing money.

But it's important to recognize that leverage will also increase the volatility of investment returns, resulting in a greater loss if the investment ends up losing money.

Recent market weakness has resulted in the use of reverse leverage becoming increasingly commonplace. Reverse leverage provides a way for investors to risk less of their own money to reduce the return volatility and enhance safety.